Electronics OEM M&A ramps up across Europe

Europe's booming EMS supply chain sees increased M&A driven by strategic realignments, market expansion, and tech acquisition, with interest from Asia and private equity reshaping the industry.

Europe's booming EMS supply chain sees increased M&A driven by strategic realignments, market expansion, and tech acquisition, with interest from Asia and private equity reshaping the industry.

Europe's EMS market is booming. OEMs grew at 11% last year, and are projected to reach record revenues in 2030 - driven by automotive, healthcare, and industrial demand. While Germany leads, the UK sees strong growth through outsourcing. However, Europe heavily relies on imports.

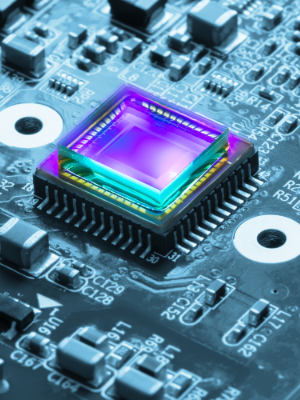

The PCB market is growing steadily, focusing on sustainability and advanced tech for EVs and medical devices. Consolidation through M&A is accelerating as companies seek stronger technology and market presence, driven by supply chain shifts and re-shoring opportunities. Despite challenges like import reliance and environmental regulations, investments in IoT, EVs, and government initiatives like the European Chips Act are shifting EMS industry structure.

Driven by strategic realignments, market expansion, and the pursuit of specialised capabilities, the European electronics manufacturing landscape is witnessing notable cross-border M&A activity, including both divestitures of non-core assets to international players and acquisitions aimed at entering new markets and bolstering technological portfolios.

Amid more independent contract manufacturers receiving unsolicited approaches to buy their company, business owners and CEOs need to know how best to respond. Having an experienced M&A advisor in your back pocket helps you explore offers while keeping you up to speed on competitors changing hands or securing major investment.

Additionally, with so much going on, it’s a good time to work out your own growth strategy, succession plans and shareholder exit options. An impartial M&A advisor like CapEQ helps you weigh up the pros and cons of each route.

Whether you are regularly being approached by potential acquirers or just pondering what selling your business involves, CapEQ is here to help.

With nearly 100 client businesses successfully sold over 20 years, our senior advisors are can offer you a free one-to-one consultation to help you get clear on your growth plans and exit options.

Sell, acquire, or raise capital for a business with our expert support.

Get in contact with us if:

We’re happy to offer advice and discuss how we could work together to get you the best results.